Shorted 2026: AI-Powered Reports, Redesigned Dashboard, and More

Shorted 2026: What's New

We've been busy. Over the past few months, Shorted has gone from a simple short interest tracker to a comprehensive market intelligence platform. Here's everything that's changed.

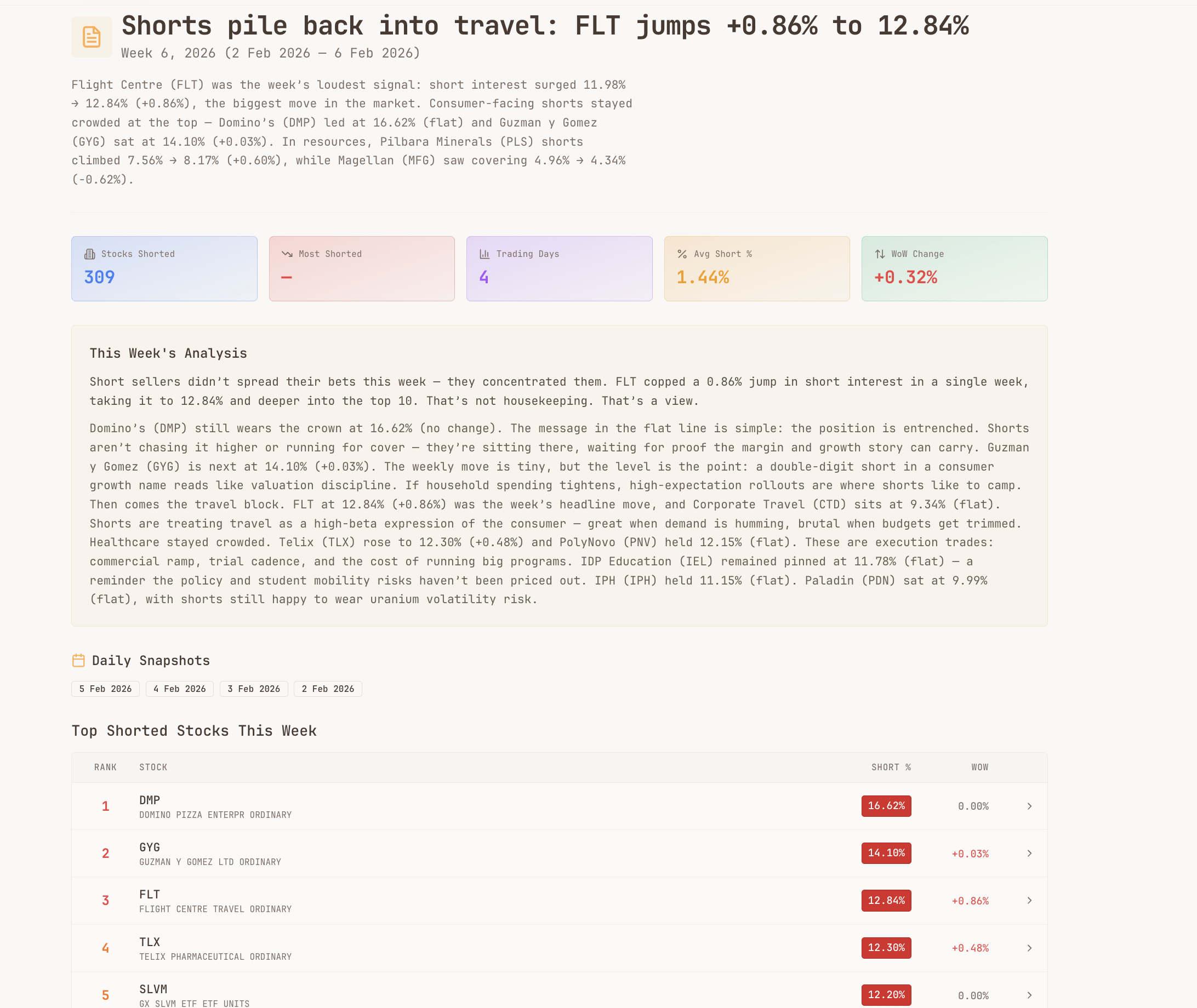

AI-Powered Weekly Reports

The biggest addition is our new weekly short selling reports. Every week, our system automatically analyses ASIC short position data and generates a comprehensive report covering:

- Top shorted stocks with week-over-week changes

- Biggest risers and fallers in short interest

- Industry analysis breaking down sector trends

- Market outlook with forward-looking commentary

- Financial snapshots pulling key metrics from recent company reports

Each report is generated using a multi-stage AI pipeline that combines market data analysis with narrative generation, producing reports that read like they were written by a financial analyst — because the AI was trained on thousands of them.

The reports update automatically after each trading week, and you can browse the full archive going back months.

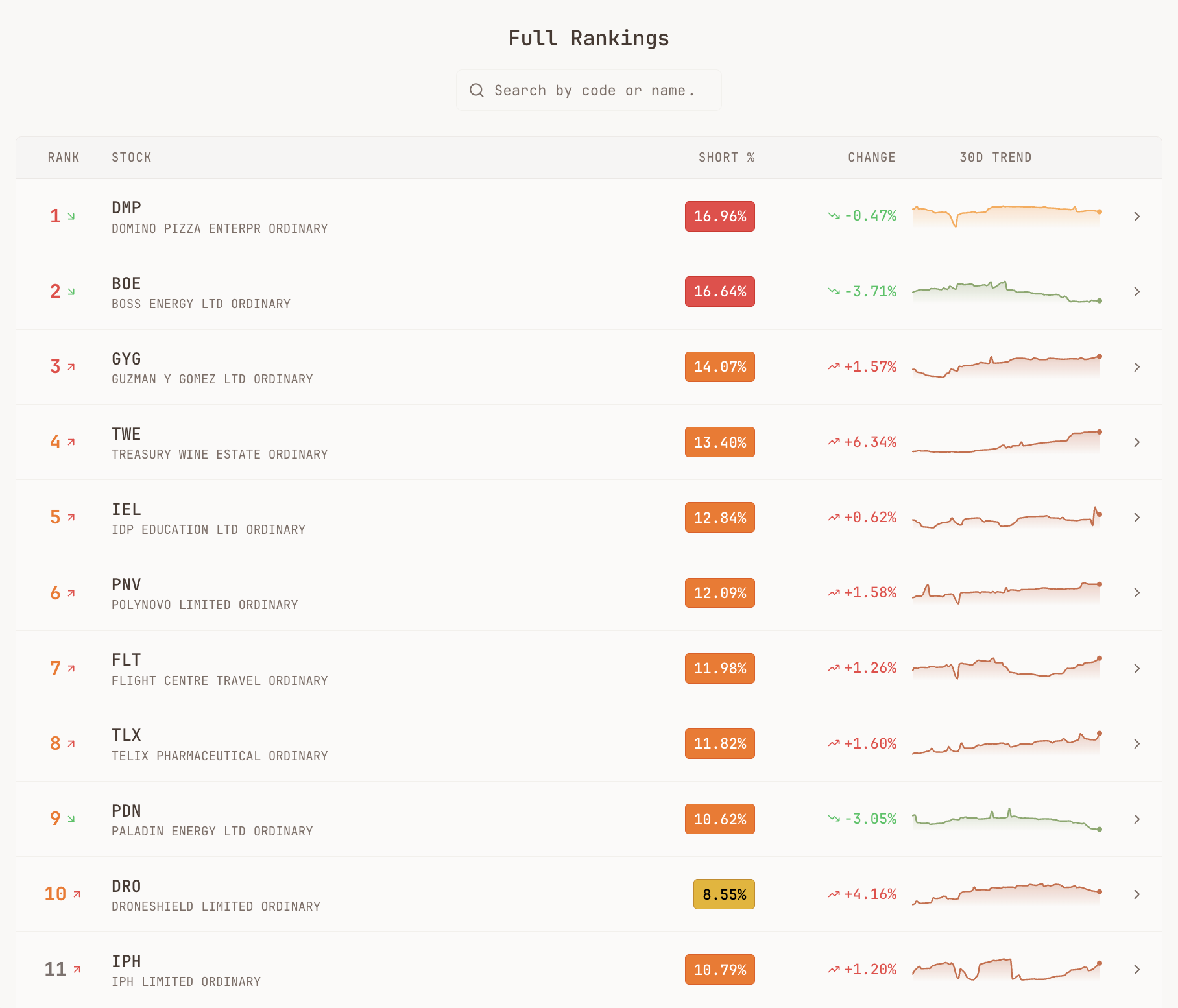

Redesigned Top Shorted Page

The top shorted stocks page has been completely rebuilt. The new design features:

- Market Sentiment Gauge — an at-a-glance indicator of overall short selling activity

- Key statistics — highest short %, average across the top 100, and count of heavily shorted stocks

- Big Movers section — rising bears, covering shorts, and the most volatile positions, all visible without scrolling

- Industry Breakdown — a treemap showing which sectors are attracting the most bearish attention

The full rankings table now shows trend sparklines so you can instantly see whether short interest is rising or falling without clicking into each stock.

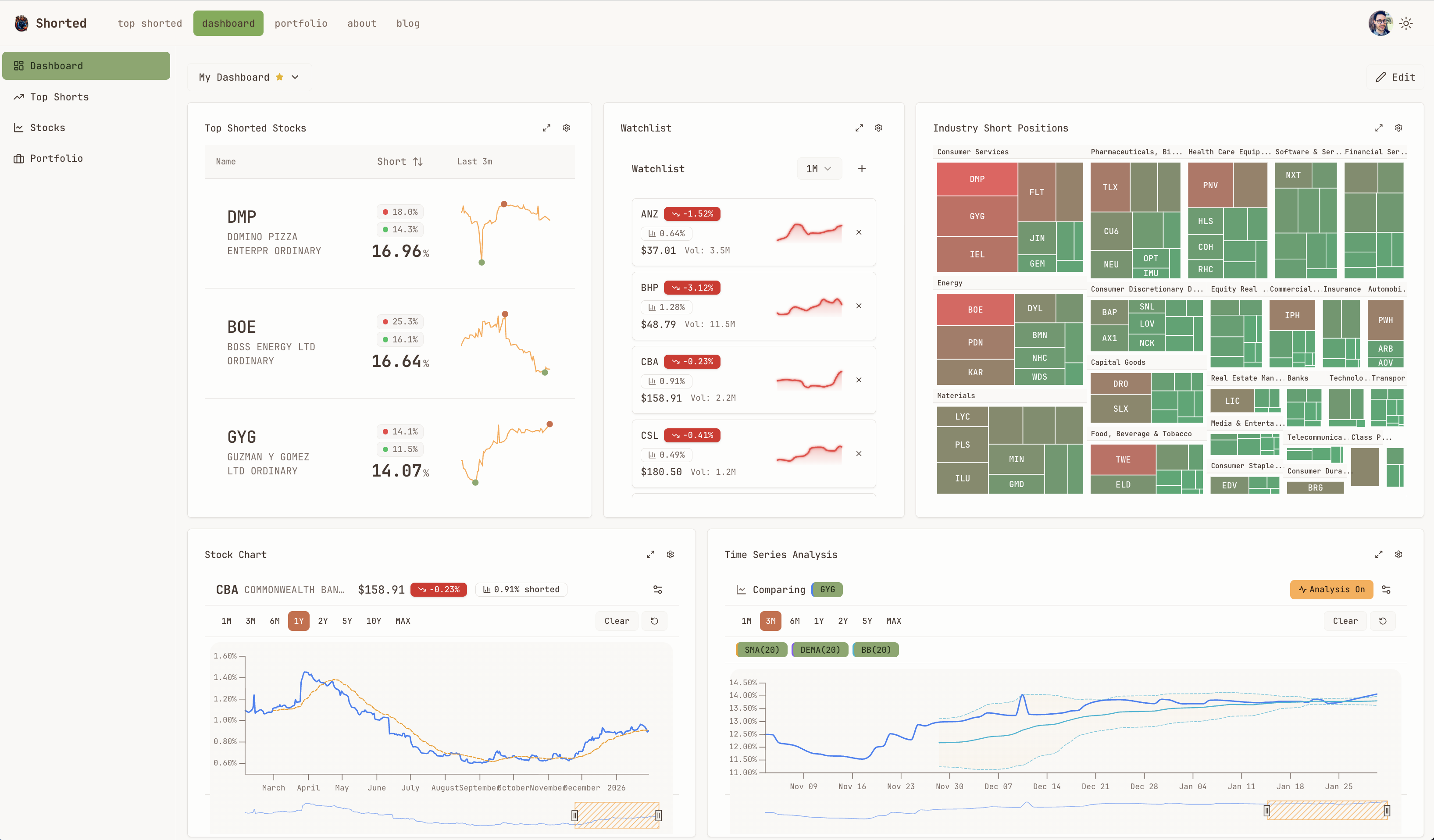

Customisable Dashboard

The new dashboard puts you in control. Rather than a one-size-fits-all view, you can now arrange widgets to match your workflow:

- Top Shorted Stocks widget with configurable count

- Watchlist tracking your selected stocks with price and short interest data

- Industry Short Positions treemap showing sector-level bearish sentiment

- Stock Chart with price and short interest overlay

- Time Series Analysis for comparing multiple stocks over time

Every widget is draggable and resizable. Your layout persists across sessions, so you can set it up once and have your personalised market view ready every morning.

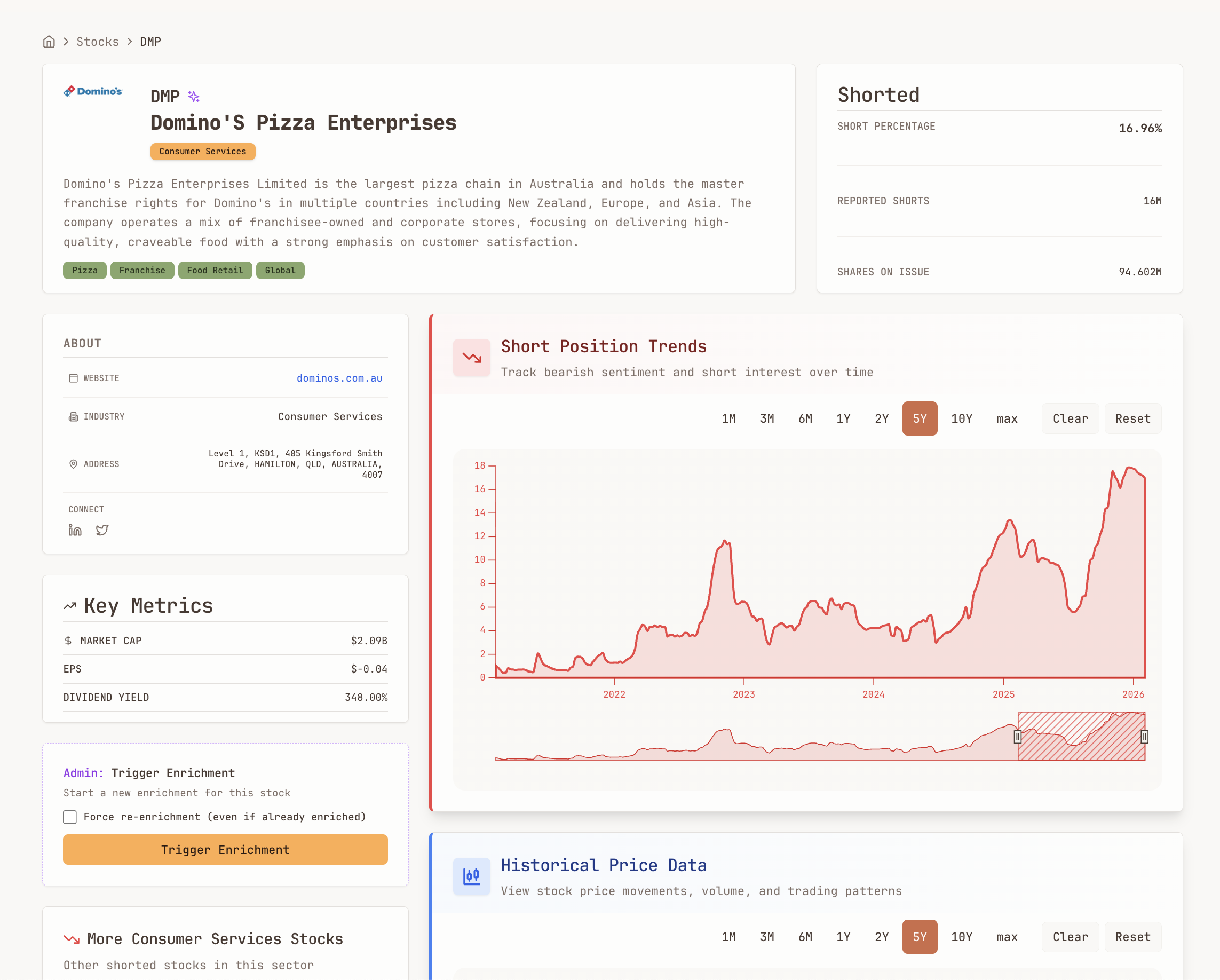

Enhanced Company Profiles

Individual stock pages have been enriched with significantly more data:

- Company overview with AI-generated description, sector classification, and key people

- Short Position Trends with interactive charts spanning multiple timeframes

- Key Metrics including market cap, EPS, and dividend yield

- Historical Price Data with volume analysis

- Related stocks from the same industry for easy comparison

For admin users, there's even a one-click enrichment trigger to refresh company data on demand.

What's Coming Next

We're not slowing down. Here's what's on the roadmap:

- Monthly and yearly reports with deeper long-term analysis

- Alert system for significant changes in short interest on your watchlist

- API access for developers and quantitative analysts

- Mobile app for checking short positions on the go

If you haven't visited Shorted recently, now's a great time to take another look. The platform has evolved significantly, and we're just getting started.

Related Articles

Which ASX Sectors Get Shorted the Most — And Why

From lithium miners to buy-now-pay-later fintechs, some ASX sectors attract far more short selling than others. Here's what drives bearish bets across the market.

A Beginner's Guide to Using Short Selling Data in Your Investment Research

New to short interest data? This plain-English guide explains what short selling data means, why it matters, and how to start using it in your ASX investment research today.

Unveiling Short Positions on the ASX: Introducing Shorted

Explore how Shorted brings clarity to short selling activities in the Australian stock market.